A Carbon Emissions Land Tax can change the face of Scotland

The John Muir Trust shares new version of a Carbon Emissions Land Tax (CELT) proposal, following initial meetings with Scottish Government officials during the winter of 2023.

Revenue projections show that a Carbon Emissions Land Tax (CELT) could initially raise between £81 million and £163 million a year for rural councils. These revenues would diminish over time as large landowners take action to manage the land to soak up carbon, boost biodiversity and strengthen communities.

In an updated version of our CELT proposal, the Trust suggests that a fixed rate of tax be assigned to different land types according to their potential for carbon sequestration and nature restoration. Landowners then have the opportunity to apply for rebates that reward good land use.

For example, a parcel of land could be eligible for rebates if the landowner protects and restores certain critical habitats like peatlands, riverwoods (riparian woodland) or rainforests. If a landowner is a custodian of a protected area such as a SSSI, they could claim a rebate for maintaining the area in favourable condition.

Using a rebate system, the Scottish Government would be able to encourage management that delivers for the climate, nature, and people. Importantly, legislative mechanisms could also be built into legislation to give CELT greater flexibility in the future. For example, the Scottish Government could have powers to change the rate of rebates or add new rebate conditions as the situation on the ground develops.

The John Muir Trust is very optimistic about the potential of this new version of the Carbon Emissions Land Tax to deliver for wild places. Thomas Widrow, Campaigns Manager, said: “When we began working on this alternative, we were hoping to address some issues with the original policy proposal around costs of administration and long-term policy relevance.

“This process led us to develop this new version of the Carbon Emissions Land Tax. We found that not only does it solve the issues in the first proposal, but it simplified the process from the point of view of landowners as well. With the rebate system, landowners will know exactly what they need to do to bring down their tax bill. This will give them the confidence they need to invest in restoring the land for climate and nature.”

“We have already presented our updated CELT to Scottish Government officials, and we were delighted by the positive reception on their end. We are hopeful that we can secure a firm commitment from the Scottish Government to implement this ground-breaking tax.”

Find out more

The Trust has published an updated policy briefing available to read here.

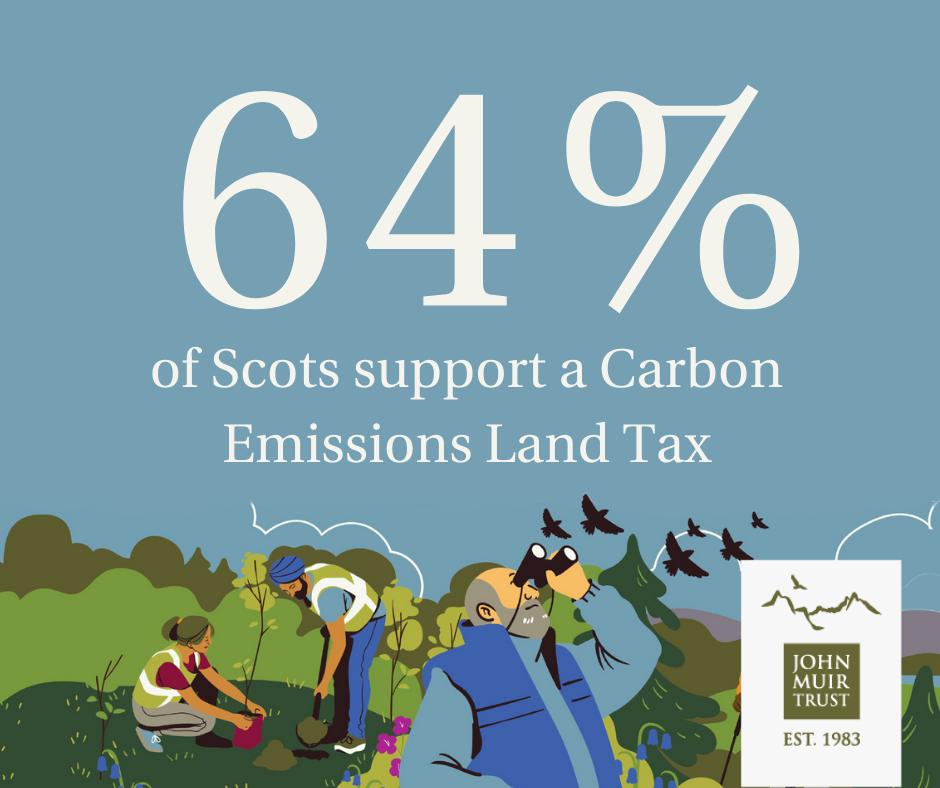

We also launched a public campaign asking Scottish voters to support the proposal by signing our petition. So far, it is backed by over 50 organisations, charities, trade unions, churches and local community groups representing over a million people in Scotland.

Show your support!

Join the campaign to lock up carbon, boost biodiversity and strengthen rural communities.